Investment Advisors for Dummies

Table of ContentsIndicators on Investment Advisors You Need To Know5 Simple Techniques For Investment AdvisorsThe Ultimate Guide To Investment AdvisorsThe Greatest Guide To Investment AdvisorsThe Greatest Guide To Investment Advisors

When a connect develops, it pays out a passion price, typically two times a year. When you make use of a connection ladder, the maturity partners are wavered, leading to a stable flow of profit.Pension deliver a stable revenue for the rest of your daily life without you must carry out a lot. At times you can even opt for a pension that includes a named beneficiary. While a pension is actually not as individually versatile as a 401k, it gives a guaranteed income throughout the rest of your lifestyle, as long as the company continues to view excellence.

For example, an individual might get 1% of the ordinary earnings over the final five years with the business. If you were actually creating $100,000, you would certainly get $1,000 a month for the remainder of your lifestyle. A reverse home mortgage enables you to take the equity in your house as well as turn it in to cash money.

To access a reverse home mortgage, you need to be 62 years or even much older as well as have enough equity in your property to obtain against it. You can pick your payments from a reverse mortgage in a monthly remittance, one large amount or even as a pipe of credit rating. When you purchase a reverse mortgage loan, you don't make any sort of finance settlements.

A Biased View of Investment Advisors

Other property expenses: You are actually still responsible for your real estate tax, insurance, affiliation fees as well as other expenses to sustain your residence. No income taxes: You do certainly not possess to pay out tax obligations on the cash money you receive from a reverse mortgage. Associated fees: Because a reverse mortgage loan is a lending, it collects passion and also costs.

MONEYGEEK professional TIPReverse mortgage loan payments are actually based upon the value of your home and also present financing prices. As of 2022, the maximum volume somebody can easily earn money through a reverse mortgage loan is actually $822,375. Every paycheck you receive has a percentage removed that enters into Social Safety for a lot of people.

It's certainly not need-based or confined by profit or even assets.: Social Protection is collecting additional than it pays for out, making it a safe and secure type of earnings for years to come. Social Safety and security is the most widespread kind of revenue for retired adults in The United States. More mature adults require to think about the resources of income, exactly how considerably they have, what they need to have to spend each month, and also how lengthy it will definitely last you.

How Investment Advisors can Save You Time, Stress, and Money.

Some funds, like 401ks, call for withdrawal at a specific age. Some earnings streams will definitely carry on to function for you while others cost withdrawing from as quickly as possible.: Withdrawing coming from a 401k prematurely or even taking huge amounts of funds from other suggested profit flows can easily cause big income tax effects.

If you are actually not positive creating your expenditures or even approaches, look for a specialist to help you. It's certainly never prematurely to start see here now executing methods that maximize your income. Even though retired life feels a lengthy technique away, there are actually factors you can begin carrying out today to boost your finances in order that you're get later on.

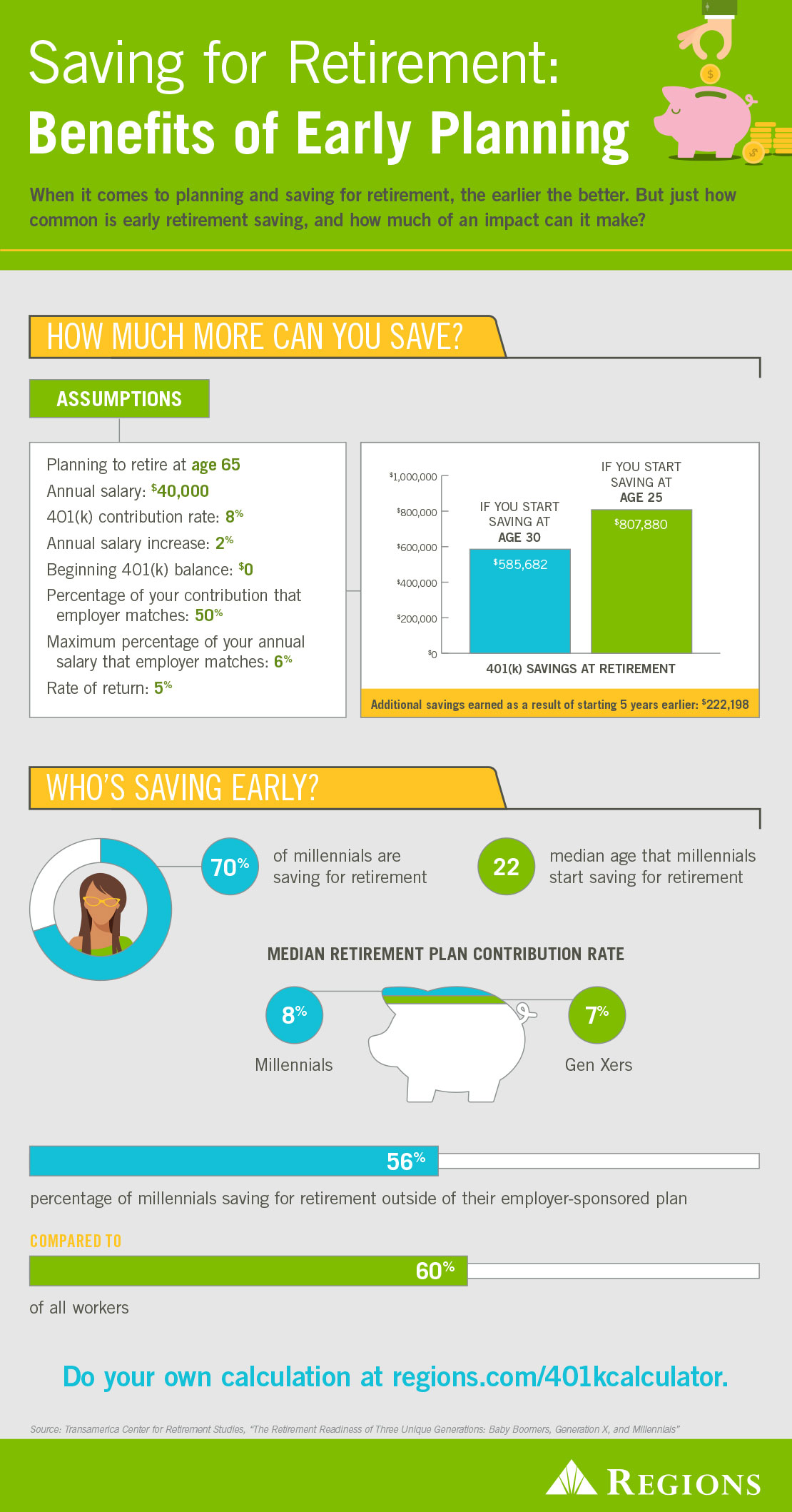

Limit you can result in a 401k is actually $19,500, and the earlier you may begin contributing, the more you'll get from magnified passion for many years. 2Explore the numerous flows of earnings that our experts discussed previously. You can start operating towards a number of these long prior to you resign, like purchasing connections and pensions.

It may be testing to know the amount of to conserve without knowing the precise grow older you will certainly resign or even what inflation will definitely appear like when you do. You likewise require to consider exactly how lengthy you might stay. investment advisors. There are many longevity calculators you can easily make use of, like the Society of Actuaries endurance cartoonist.

Facts About Investment Advisors Revealed

It is actually likewise certainly go now not very likely sufficient cash to spend all of your expenses in retirement life. Maintaining all of your loan in money suggests that you aren't helping from creating money on your money, and you do not keep up-to-date along with rising cost of living.

That indicates the amount of money you have right now will certainly certainly not be actually worth the same quantity in five, 10, or even 15 years. A big error in loan monitoring is actually not factoring rising cost of living right into your organizing.

Fraudsters are going to construct partnerships with their intendeds by means of email or even telephone, and over 90% of the moment, the scammer is actually a member of the family. Make use of the adhering to steps to steer clear of the absolute most usual kinds of frauds to protect on your own and your financial resources. 1It can be actually testing to recognize frauds if you do not recognize what to check out for.

9 Easy Facts About Investment Advisors Shown

4Before you deliver any sort of private info or amount of money to somebody over the phone, email, or even online, hunt for their call relevant information to identify that they are that they claim they are. Do certainly not provide in to the feeling of seriousness and take the opportunity to guarantee that the person inquiring for your information or even properties is certainly not a fraudster.